Reflect on the Past 45 Years of the Pet Industry

Glenn Polyn //December 28, 2016//

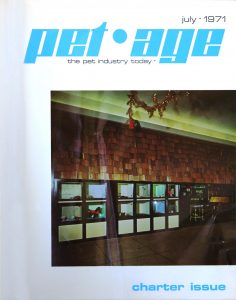

Pet Age magazine was born out of the marriage between Horst H. Backer and his wife Sue Busch, blending his expertise in public relations and show management with her creative and publishing background. The inaugural issue, published in July 1971, contained an introductory letter from Backer where he stated “Pet Age is a ‘new concept’ publication devoted to the entire Pet Industry today. Our aim is to serve you and we trust you will make Pet Age an integral part of your business.”

Since then, the magazine has become the most subscribed to publication in the pet retail industry while simultaneously growing into a media powerhouse. We have continued to expand the magazine’s media footprint, thanks to our website, e-newsletter, community outreach and multiple social media channels.

The Evolution of Retail

As it is in all business environments, becoming aware of emerging trends before they become  obvious to the masses is necessary in the rapidly changing pet industry.

obvious to the masses is necessary in the rapidly changing pet industry.

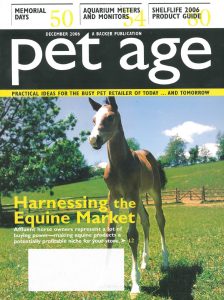

“I think the first big change was the growth of the pet superstores, which became PetCo and PetSmart and really the late ’80s into the ’90s is where you really started to see that change and that was also the period in which you had a lot of distributors start to consolidate as well,” said Steve King, president of Pet Industry Distributors Association (PIDA). “So we went from over 150 distributor members of PIDA down to half that number in the space of a decade in the late ’90s and early 2000s. And part of that was corporate ownership coming in, but part of it was also the realization that the retail environment was changing and folks needed to get bigger and more efficient in order to compete in the new environment.”

Pet Age covered the changes facing retailers in the January 1992 cover story, “The Pet Store of the Future.” The article detailed how the new concepts in marketing and merchandising was affecting the way pet stores needed to look in order to survive the challenges that faced independent pet stores.

“The pet industry is ever-changing,” said Chris Miller, president of Pacific Store Designs (Orange, California). “We’re seeing large mass marketers and superstores affecting smaller retailers who aren’t good operators. The good operators–small to medium–will survive… There will be a weeding out of the industry.”

The article cited experts who correctly predicted a split among pet retailers, some that will sell a wide variety of products and small stores that specialize in one type of animal and related products.

Ed Kunzelman founded Petland, a privately owned operator and franchisor of pet stores based in Chillicothe, Ohio, in 1967. Petland franchised its stores since the early 1970s and, by the early 1980s, it began expanding into Canada and to overseas markets, including Japan, China and South Africa. In 1995, Kunzelman founded Aquarium Adventure, a wholly owned subsidiary of Petland, after developing the concept for an aquatics-only store with Bill Wymard, a Petland franchisee and marine biologist.

“I always had a thing for entrepreneurship,” Kunzelman said, adding that he sold fish out of his house as a youngster. In 1967, when he was a school teacher, he noticed that there wasn’t a pet store in his town. “My friend and I borrowed $800 apiece from the teachers’ credit union and we opened the pet shop in October 1967.”

The retail pet industry was a “mom and pop” business back then, with shops specializing in a specific pet category. Kunzelman noted there was no industry standard and no chain stores.

“There were fish shops and bird shops,” he described. “We didn’t have dogs and cats in the beginning. We had a big emphasis on tropical fish. Back then, reptiles were also in vogue. Parakeets and parrots, too. Back then there were mostly wild-caught parrots. And a couple of times we sold monkeys.”

Considered exotic even back in the 1970s, squirrel and capuchin monkeys were a trending pet, as were myna birds. However, according to Kunzelman, the government set up quarantine stations that resulted in increased costs.

“Our mission is to find the best pets and create an experience that will turn out great for the pet and owner, so we banned the idea of any primates and wild-caught birds,” he said. “Then people started domesticating them and raising them domestically, but we were trying to focus on children and what pets were best for them, like canaries and parakeets. Hamsters and guinea pigs were also popular first pets.”

There were some requests for dogs from Petland customers in the early 1970s, Kunzelman explained, but they weren’t as popular as they would become by the end of the decade. And there was not much of a demand for cats.

“We like our stores to be balanced. Great birds, small animals, reptiles, and if our store has puppies, we want them to be great puppies,” Kunzelman said. “The goal we have is for our stores to have them be balanced in terms of the animals we offer. It’s not the volume, it’s not the numbers. People that already have a puppy, they might still want to interact with a different breed. We offer socialization.”

With the increased scrutiny from the news media and animal rights groups like People for the Ethical Treatment of Animals, retailers are faced with the balancing act of selling animals in a responsible manner and selling enough animals to stay in business.

Pet Age focused on that topic in a November 2006 cover story titled “Selling Animals Responsibly.”

“It’s a very different attitude than it was in the 1960s, 1970s, 1980s, and 1990s,” said Rick Preuss, whose family has owned Preuss Animal House in Lansing, Michigan, since 1965. “The slope of concerns about animals is upward. I always tell people who don’t believe me to look at zoos. Are zoos the same as they were in the 1960s? No, because of the generally increasing value people place on the lives of the animals. So why should pet stores be any different?”

Nutrition Knowledge

Nutrition Knowledge

A driving force in pet nutrition and pet health has been Mars Petcare, with brands that include Pedigree, Whiskas, Royal Canin, Iams and Banfield, just to name a few. Mars Petcare is a private, family-owned business that originated when Forrest E. Mars Sr. moved to the UK and acquired Chappell Brothers, Ltd., makers of Chappie canned dog food.

Besides establishing the Waltham Centre for Pet Nutrition in 1965 in the UK, Mars set its sights in the U.S. on the pet industry when it purchased Kal Kan pet food in 1968.

“In the 1970s, pet care was still pretty fragmented across the U.S.,” explained Todd Altemeier, integration director for Mars Petcare North America. “Ralston Purina was the big guy, and for other food manufacturers it was more of a hobby than a business. But Mars vowed to be one of the top two in pet food. And, as of 2016, Mars is No. 2.”

By the mid-2000s it was difficult to find American-made pet products, but then in 2007, the Food and Drug Administration learned that some pet food ingredients sourced from China were contaminated with melamine. Used in plastics, inks and fertilizers, melamine had been mixed with wheat gluten to make the pet food appear to have a higher protein level. The tainted pet food scandal, which was the largest pet food recall in U.S. history, was followed by a controversial report about lead levels in certain pet toys.

Bob Vetere, president and CEO of the American Pet Products Manufacturers Association (APPA), sent out a warning sign in the December 2007 issue of Pet Age.

“The pet food recall was a wake-up call to everyone in the industry who wasn’t paying attention,” he said. “What happened with that, and with the Mattell recall, is that manufacturers got a chance to see what went wrong and to compare it with their systems and to see if the same thing could happen. You’re seeing companies, even those who didn’t have problems with the pet food recall, improving systems and changing sourcing.”

The mission of APPA is to promote responsible pet care as it works to grow and advance the pet products industry. Founded in 1958, APPA is a leading trade association in the pet industry, providing a wealth of services and programs such as partnering with PIDA to present Global Pet Expo, a top event in the industry.

According to Altemeier, the 2007 pet food recall was a wake-up call to regulatory, and Mars didn’t respond by sitting on its heels.

“It led to a lot of insight into the pet care industry,” he said. “It became loud and clear, consumers are expecting pet food companies to be more transparent, like with human food. Mars was the leader in the industry taking the next step. We were going to lead the way in being better, with quality and food safety. We were not going to put up with it.”

Over time, and with the help of Mars Veterinary and the Waltham research center—the scientific data of which Mars shares across the industry through symposiums and public papers—Mars continues to reformulate and improve upon its many pet food lines. One example is the addition of taurine to cat food—Mars oversees a brand structure of food that ranges from Whiskas to Iams up to Royal Canin—when research out of Waltham revealed that the essential amino acid is critical for vision and heart muscle function.

Educating Consumers

One of the concerning recent trends in the pet world is the steady decline in bird ownership. The 2015/2016 APPA National Pet Owners Survey has the number of bird-owning households at 6.1 million in the U.S.

But the pet industry isn’t taking this issue lying down. A new organization, the Bird Enjoyment and Advantage Koalition (BEAK), has formed to better understand the downturn in the bird segment and to work on reversing it. The coalition is made up of bird product manufacturers, food providers, pet industry associations, breeders and wholesalers who seek to identify and address the issues surrounding the decline in bird ownership by providing information, education and resources to find the proper type of bird for a good owner.

The organization is also engaging with members of the veterinary industry, including the Association of Avian Veterinarians. In addition, BEAK is creating a social media presence with a Facebook page called MyBird that’s garnered 13,000 likes in its first month of existence, and an official BEAK website is planned to go active in early 2017.

“BEAK’s goal is to increase bird ownership beyond 6.7 million households by 2020 and ensure that new bird owners are aware of the needed care, handling and responsibilities of a variety of avian species,” said BEAK co-chairs Todd Regan and Brent Weinmann, in the June 2016 issue of Pet Age. “There is a need to take the time to ensure that a new bird is matched to the right type of specific home environment.”

The co-chairs have received positive feedback from retailers, and Weinmann mentioned that one retailer, Simbads Bird House (Miami, Florida) has offered to help develop a retail coalition to support the BEAK’s cause.

“We want to improve an interest in an awareness in birds,” Regan said. “And we can accelerate that with our social media effort and website.”

“A key feature of the website is that it will contain a questionnaire for anyone thinking about getting a bird, and it will help identify the right bird for them,” continued Weinmann, adding the website will be a valuable resource of avian information for prospective bird owners. “It’s about identifying the right bird for the right environment and the right personality. It wouldn’t do the industry or the bird any good if it ends up with a rescue group.”

Kunzelman echoes that sentiment, and he considers the Petland staff to be more like counselors than sales people. Their goal is matching the right pet with the right person. To customers who already have pets, the company is dedicated to enhancing their knowledge and enjoyment of the human-animal bond.

“There needs to be a relationship between the consumer and retailer. There’s heavy pressure on retailers to educate,” said Kunzelman, who noted that Petland puts a great amount of time and effort into training staff. “Our forte is training. We educate our staff so they can educate the consumer. If you’re really nice to the staff, they’ll pass that on to the consumer.

“It’s our responsibility to educate people so they can bring a pet home and have a happy pet and happy owner. We tell kids about the responsibility in raising a pet. It’s a living thing. Counseling is important.”

The topic of puppy mills has become an even more serious threat to retailers.

When it comes to the topic of puppy mills, Kunzelman doesn’t shy away from Petland’s stance that it is strongly opposed to any puppy breeding operation that disregards the health and well-being of breeding dogs or their puppies. The company has announced its locations that sell dogs do not source them from puppy mills, instead obtaining puppies from USDA-licensed and inspected breeders with clean records, hobby breeders and animal welfare organizations.

“We always sought out responsible breeders,” he said, and Petland states that it works with federal, state, local and other organizations to educate breeders on proper animal care. “The sourcing of pets is important.”

And after a customer brings home a pet, Petland offers the Pets for Lifetime program. If something goes wrong or there’s a life event, such as the pet owner has to move or leave home for college, the company will help the pet owner find a new owner for the pet.

The pet industry is different than any other retail, according to Kunzelman. It’s more of a lifestyle than a business.

“With pets, there are no holidays,” he explained. “We don’t get a day off, and we have to get into the store early for what we call procedures. You don’t do this if you don’t love the hobby.”

Dedication and Generosity

That love for the hobby and passion for animals often dictates not only how pet industry insiders do business, but also with whom they do business. Social responsibility is a core value for many businesses, and members of the pet industry share these important values. Choosing business partners based on their philosophy and dedication to animal welfare has become the norm.

Jo Hunt, president of DHA Lifestyle PR, said she was able to combine business and passion when she started her company in the 1990s. In her eyes, the pet industry has gone through some major changes since then.

“It’s become an extremely sophisticated industry, and investors have become more involved,” she said, which can have its downside. “They only care about the bottom line, which sucks the soul out of the industry, but not all investors are bad.”

While she started with two pet accounts, that number has grown leaps and bounds, with nearly 95 percent of her clients being from the pet industry.

“The businesses I represent, like Solvit and earthbath, have generated a lot of interest,” she said. “My clients are very solution-oriented, practical, with a focus on safety, mobility for senior dogs, ideas that attract attention. People take their pets everywhere, so these businesses come up with solutions for daily needs.”

When Hunt reminisces about her early days in the pet industry, she recalls there being more small retailers and entities at trade shows, which is where she scouts out new clients. While she notices that other industry trade shows are on the decline, that’s not how it is in the pet industry.

“The booths are huge, like those at an electronics show,” she said. “And we’re now attracting international manufacturers.”

What does Hunt look for in a new client? A company that manufacturers products that “are nice looking, are quality made, and where a portion of the company’s proceeds goes to charity.”

Pet retailers, distributors and manufacturers have been known to demonstrate their generosity to people and pets. Some members of the pet industry create nonprofit branch that allows them to better support causes they believe in or they dedicate portions of their product to help make people aware of animal issues. They make it a priority to give back to society because that’s who they are.

Joey Herrick, the president and co-founder of Natural Balance Pet Foods, is one of Hunt’s  clients. For years he donated Natural Balance pet food to animal rescue groups because, he explained, it was his belief that it is the animal rescue people who go into shelters and take animals off death row and put them into foster homes.

clients. For years he donated Natural Balance pet food to animal rescue groups because, he explained, it was his belief that it is the animal rescue people who go into shelters and take animals off death row and put them into foster homes.

“I donated millions of pounds of food to animal rescue groups because they lowered the euthanasia rates in America’s shelters,” he said. “After I sold Natural Balance (in 2013), I didn’t have the food to give any more. So I took $800,000 and started a foundation, and vowed I won’t take a dollar from it.”

In creating The Lucy Pet Foundation, Herrick’s plan was to offer no-cost or low-cost mobile spay and neuter clinics in order to cut down on the number of unwanted animals being born and make a dent in what he estimated to be 80,000 dogs and cats being euthanized each week.

“We started with two mobile spay/neuter mobile buses, two veterinarians and two additional vets that we contracted with,” he said. “We were doing it correctly, and this year alone, we’re going to spay/neuter 4,500 animals. In 2017, we plan to fix 6,000 animals. This is a program that I want to put all over the country.”

Herrick estimates he’s put $2 million of his own money into the organization, which has built a strong reputation. And to continue with his goal of reducing the numbers of dogs and cats being euthanized, he created Lucy Pet Products, with all profits from the company going into The Lucy Pet Foundation.

When Herrick left Natural Balance, he had a non-compete clause which prevented him from manufacturing pet food. Lucy Pet Products started with a line of shampoos that was successful. That was followed with litter.

“Litter is a boring industry, so we patented a two-handle bag with a side spout, and now there’s nothing like it on the market,” he noted, recalling the day he had lunch with Rick Rockhill, executive vice president of Lucy Pet Products, and Karen “Doc” Halligan, a vet from the foundation. He informed them that they were meeting with a $54 billion company to ask for an exclusive on their product.

As the team arrived at the company for the meeting, Herrick had them take a photo in front of the company’s sign because he knew it could be a special moment. That company was Dow, which ultimately approved giving Herrick the exclusive on its product.

“I’m going to make Lucy Pet Products into big company to raise money for the foundation, and in turn make the Lucy Foundation a very respected charity,” he said. “I want to lead and let people follow. I never want to be a ‘me too’ product. This is such a wonderful industry. I’m 62, and when I think ‘what is my legacy?’ I want it to mean something. I want to be the guy that made a dent in the 80,000 dogs and cats being euthanized each week.”

The Quest for Quality

The Quest for Quality

One of the major pet product trends has been the upsurge in demand for premium foods. This started in dog food, but has in recent years spread to almost all the pet animal categories. These premium diets include all types of higher quality—and higher price point—foods: organic, all-natural, grain-free, exotic protein, probiotic and more.

According to King, the trend started several decades ago.

“That was the other big change that started back in the ’70s and ’80s with some of the first premium and super premium diets coming along,” the PIDA president said. “Hills certainly was one of those, but Iams more than any other created a whole new category of pet specialty. They changed the equation of how people thought about pet nutrition and the ability of independent retailers in the pet specialty channel to capture a bigger part of the whole food business, dog and cat being the dominant part of that.

“So today we have just an absolute explosion of different types of diets, different types of ways to feed animals and make them healthy, and lots of different theories about them and nutrition that really has been developed in the pet specialty channel and that all came from those first days of creating those premium diets for folks to feed their pets.”

Natural Balance was part of that trend toward elevating pet nutrition.

“I built a team of top nutritionists and veterinarians and asked them to create a dog food and not worry about money, where it was what’s best for the animal and not about the corporate bottom line,” Herrick recalled. “That was 30 years ago. Our dog food was not using by-products, not using ingredients because they were cheap. I was first using hickory smoke so the food didn’t smell and stink up the house. Our canned food for dogs always smelled good.”

The non-compete clause between Natural Balance and Herrick ended on July 15, which means he’s allowed to manufacture pet food. He said test batches are already being produced and the pet industry can expect to see Lucy brand dog and cat food coming in 2017.

“I don’t want to do the same old, same old,” he said. “It’s going to be cutting edge stuff, and we’re always doing what’s best for the animal, not the bottom line.”

The humanization of pets has been a top trend in the industry, as evidenced by pet food makers identifying new pet foods billed as functional with human-grade ingredients and hyper-premium products. One such company that fits into that category is Evanger’s.

Evanger’s was incorporated in 1935 by Fred Evanger with the goal of making pure meat canned foods that provided superior nutrition to prevent any dietary deficiencies.

When Holly and Joel Sher bought the company in 2002, they continued the tradition of being a family-owned, family-run company and enabled Evanger’s to boast being the only woman-owned cannery, as well. Their pet food continues to be manufactured on the original site with all the meat being sourced locally. The Sher’s twins, Brett and Chelsea Sher, even launched Against the Grain, a line of grain-free dog and cat food.

“Why reinvent the wheel?” asked Holly, proud of being a small company that had 10 employees when she took over Evanger’s. “We’re still creating the same quality product. Our ingredients are fresh from local delivery, and we grind our own meat and vegetables.”

According to Holly, Evanger’s was the first company to have pheasant in pet food, then they moved to quail. The company continues to seek out ways of improving their product, adding a nutritionist and even being endorsed by a rabbi to be at kosher plant.

In 2003, Evanger’s was the first pet food company to create a food where the meat and vegetables are packed by hand instead of machine. And in the first quarter of 2017, the company plans to release Nothing Else, which it described as the first single ingredient, 100 percent meat dog food on the market. There is no added water, and the food is free of grain, gluten and preservatives.

Keeping it Natural

Jones Naturals, LLC is another family-run business that prides itself in offering natural  products that are made in the USA. The company started in 1850, when meat cutter Stephen Jones set up his shop in Rome, New York. In 1970, Robert L. Jones, the fifth generation of the Jones family in the meat cutting business, established Jones Locker Service in Woodstock, Illinois.

products that are made in the USA. The company started in 1850, when meat cutter Stephen Jones set up his shop in Rome, New York. In 1970, Robert L. Jones, the fifth generation of the Jones family in the meat cutting business, established Jones Locker Service in Woodstock, Illinois.

In 1987, well ahead of when the natural chew products were common, Jones Locker Service manufactured its first dog chew, which were grizzle stick backstraps. That was immediately followed by pork skin and pig ears, which were quickly a hit and have remained the most popular product to this day.

After expanding into bones, the company—now known as Jones Naturals, LLC—currently manufactures 77 dog treats, with another seven to premiere at Global Pet Expo. The company has also grown in terms of staff, starting with 8 employees in the 1980s and now numbering 125, which includes full-time safety crews.

“The industry is very extreme compared to 1987,” said Laura (Jones) Lang, co-owner of Jones Naturals, LLC. “I can’t imagine being a startup right now.”

Jones Naturals, LLC has expanded with demand, which Lang describes as being very strong, yet the company has been careful of managing its growth. The company, which sells to distributors, began its expansion in the Midwest before moving to the East Coast followed by the West Coast in 2006.

“When it comes to our product, we’re very picky, very selective,” she exclaimed. “We offer meat treats and natural body parts, which will always have a place on the shelf. Our products are what dogs have always wanted in nature. We strive for consistency in quality. We have a reputation, which is based on feedback from consumers, and that’s ‘quality.’”

The category of natural product can also include accessories, and Leather Brothers has a long history of producing pet products crafted from natural materials.

Leather Brothers, Inc. was established in 1976 by brothers Louis and Steve Schrekenhofer. They are third generation leather workers who began their career working with their father, George Schrekenhofer Sr.

“We came up with the name when my brother and I showed up at home wearing leather jackets,” Steve Schrekenhofer recalled. “Our mother said, ‘look it’s the leather brothers.’”

Much more than just a catchy name, the company supplies its products, many bearing the OmniPet by Leather Brothers brand name, to a network of dealers and distributors worldwide.

“We were producing items for the hunting trade when we started,” he said. “It was for the hunting industry and horse tack. In 1982 we decided to focus on dog products. Dog categories were getting larger, and it seemed like there was more opportunity in the dog area, and that’s what our dad did before we started our business. Dad did shoe repair, but he also made halters and dog collars.”

The company was crafting only leather goods in the 1970s before adding nylon products starting in 1982. Today, a variety of products in a wide array of styles, colors and materials are now available. Although there have been trending fabrics with embroidery and ornamentation over the years, leather is still what the company is known for, and it continues to get requests for one of its first collars from 1982.

“Our signature line is still leather, but we’ve gone into 60 different colors of leather, plus suede, metallic, faux ostrich, crocs, paisleys, rhinestone buckles, flowers, even cut glass stones,” Steve Schrekenhofer said. “The variety has just exploded. We even have soft, supple leather with spikes and stuff that are popular with pet owners of a certain type of breed.”

In the past, collars were heavy and functional for the hunting trade and were worn until they wore out. That has changed as consumers view collars as fashion statements.

“Now people have quite a few collars,” he noted. “Now they change collars at different times. I think people often look at their pet as part of the family. They spend more money on collars. They think, ‘that’s really nice, I’m going to get that.’ We’ve also added other items, like toys, muzzles, rawhides and charms. The companies that carry our products, they will give us an idea or category that they desire, so we create it, enabling us to offer a full range of items.”

It’s a family affair, with Steve Schrekenhofer’s daughter and son helping with graphic design and sales, respectively. He credits his children with being invaluable resources when it comes to creating effective products and deciding how to market them.

“It makes a big difference,” he said. “They’ve put a whole lot into this. They’re proud of their heritage, and they’re passionate about it. They’ve brought in fresh, new ideas: my son with exporting and overseas sales. That was something he was adamant about. My daughter with her fashion and design concepts. It’s a collaborative effort.”

Ecological awareness and sustainability has swept through the pet industry, ushering in wave after wave of earth-friendly pet products as well as greener manufacturing and operational practices. These changes included curtailing the amount of electricity used in manufacturing, changing hours of operation to conserve energy, installing compact fluorescent lights, making products from recycled materials that are in turn recyclable, drastically reducing packaging and more.

Ten years ago, Brian Wood was approached by a longtime friend who had invested in a bedding company.

“He hired me to run it,” Wood recalled. “But I knew nothing about bedding. After researching the pet business—bedding in particular—I stumbled across this other product line and we ultimately bought it. It was eco-bedding.”

The company, Eco-Pak/Eco-Bedding, was started in the 1990s by actor John Ratzenberger, who had invented a substitute for packing peanuts. Ratzenberger had developed a way to crinkle paper into an environmentally friendly substitute for Styrofoam peanuts.

“I think it grew to the point where the business interfered with his day job as an actor,” Wood

mused. “So he decided to sell it.

One of our lab distributors got the idea to enclose a facility with the eco bedding so the lab primates could forage for their food. It turned out to be a great enrichment product for the animals.”

Thus, what started out as a replacement for Styrofoam peanuts turned into a bedding and enrichment material for a variety of animals. By 2005, the company, now known as FiberCore, LLC, was formed and its eco-bedding line soon became a popular sustainably produced pet product.

“It was initially small animal bedding, but bird owners like it because it’s clean and there’s no dust,” Wood said. “Retailers can use it for in-store bedding. It looks good and it’s more economical. The industry is becoming aware of sustainability. They’re attracted to it based on it being recycled content, but they also love the performance.”

Worldwise Inc. has focused on environmentally responsible products since Aaron Lamstein co-founded the company in 1990. The company’s pet products are made principally from recycled, reclaimed, renewable and certified organic resources.

Worldwise follows a mission statement that “sustainable living is easier when it’s a natural choice. We also believe that making a better choice for you, your pet and the planet should never be outside anyone’s economic reach. That’s why since 1990, our mission has been to make environmentally responsible products that are attractive, affordable and accessible to everyone.”

“In 1990 there was the fringe idea of economic reasons to recycle,” Lamstein said. “The products that we developed had to look as good or better, work as good or better, and cost the same or less. We launched immense number of products over the years, the vast majority of which had performed really, really well.”

Worldwise created its own niche, focusing on pet accessories such as toys and bedding, rather than pet food or flea products. But it’s expanded since then, and has become a well-accepted mainstream manufacturer. Its brands include PoochPlanet and SmartyKat, goDog, Sherpa and Petlinks. According to Worldwise, WalMart has provided the company with 25 tons per month of cardboard for use in cat scratchers and packaging; 16 tons per month of plastic bottles to be recycled into pet-bed filling; and 30 tons per month of plastic hangers to be remade into cat litter pans.

“One of our buyers asked us to participate in a pet specialty event in 1995, and we quickly launched six new items, three of which did really well,” recalled Lamstein, adding that two of those products were a pet bed made from reclaimed cedar chips and a cat scratcher created from recycled corrugated cardboard with organic catnip. “Worldwise is the No. 1 suppliers for pet beds and cat scratchers. And the SmartyKat brand catnip is the No. 1 brand. That event was the launching pad for us.”

The Technology Revolution

The Technology Revolution

Lamstein sold Worldwise in 2011, but has remained on the company’s board of directors. He didn’t stay out of the pet industry for long, noting that he was recently approached by a friend who wanted to launch a company in the tech industry. The products are in beta testing, he explained, adding that he’s received firm commitments from leading retailers.

He views the tech area as being a trend that is becoming a huge category that will only become more important to consumers. What makes it so valuable is that it focuses on issues involved with improving the quality of life for pets and pet owners.

“For me, what makes this exciting is that it revolves around technology in an incredible way that doesn’t currently exist in the market,” Lamstein said of the product, which he expects to launch publicly in spring 2017. “It will improve pet safety, and it offers valid social and community service. It’s an integration of technology into the pet space. Our initial item is going to be a game changer.”

Another company that’s on the precipice of making a major impact in the pet industry is the F.C. Sturtevant Company. Francis Crayton Sturtevant, who vowed after the Civil War to develop a product that killed infection, founded the company in 1871 as a medical products company. With the help of his doctor/scientist cousin, Sturtevant tested the product’s efficacy on his horses and found it to be effective. It was also tested on hounds and other hunting dogs for swimmer’s ear.

Today, according to F.C. Sturtevant president Steven Rosenfeld, the company continues to produce and distribute skincare products under the Columbia brand name in North America. It sources minerals from the same Montana mine since the 1890s in order to create its pharmaceutical grade talc. The animal division, which reaches 23 different countries, produces two products for veterinarians–a small animal formulation and a large animal formulation–with a product also being offered to selective pet stores.

Rosenfeld sees a growing interest in his company’s products, especially since pet owners have a tendency to go to retailers for their medications as they find it to be too expensive to visit a veterinarian.

“We’ve helped to create an interest in retailers to offer a pet care section,” he said. “Our products are sophisticated, so we perform product training and education for retailers.”

The product offered to retailers, a canine formula, is known as Sturtevant’s Veterinary Remedies, which provides broad spectrum medicine for use in treating skin irritations, including hot spots, atopic dermatitis and minor wounds and abrasions. It’s also been proven to be effective in helping prevent parasitic infestations from mites, fleas and ticks.

“We’re known for the efficacy of our product, the safety of our product, and the value that the product offers,” said Rosenfeld, who’s been with the company for 22 years. “That’s always been our creed. We offer people and pet professionals a product that is safe, efficacious and has value.”

The company is focusing on new products, and Rosenfeld expects the one being offered in the first half of 2017 to make a major impact. He referred to Barbaro, the thoroughbred racehorse who won the 2006 Kentucky Derby but then shattered his leg two weeks later in the 2006 Preakness Stakes. The injury ended the horse’s racing career and, according to Rosenfeld, the fungal infection pastern dermatitis eventually led to his death when he developed an abscess and a severe case of laminitis.

“It was after the passing of Barbaro that we decided to find a cure for (pastern dermatitis),” he asserted. “We came up with it, and have patented a formula that can cure it.”

Nobody in 1971 could have predicted we’d make such amazing advancements in science. And we also couldn’t have foreseen that pet owners would be using handheld computers to keep tabs on our pets when we’re away from home.

As Pet Age reported in “Brave New Online World,” the feature article in its November 1999 issue, fewer than one-half of American households owned a personal computer at the end of 1998 and only one-quarter were able to go online, according to the second annual Ernst & Young Internet Shopping Study. That’s a big difference compared to today, as technology influences the way we conduct almost every aspect of our personal and business lives.

Craig Susen, the CEO of Wagly, describes technology as “a petrification of process.” With a reputation for creating innovative technology solutions, his focus on user-centric design has pushed the boundaries of the technologies he has delivered for companies like Microsoft, Hitachi, Banfield and Trupanion.

At Trupanion, Susen used his vision of e-commerce technology to help build a claims-processing system that enables fast payment of claims directly to veterinarians with pet owners paying just a 10 percent copay rather than the full sum upfront and waiting for reimbursement.

Susen called the former trend “economic euthanasia,” where owners are forced to put a pet down because they can’t afford the cost of the medical care upfront. At the same time, the system grew more advanced in terms of actuarial pet issues as well as leveraging marketing, sales and clinical data to create a better customer experience. Susen said he plans to utilize the cloud to bring disparate technologies together to create a lifeline tying legacy applications with data warehousing.

“We’re moving into a space where everything is instant,” Susen said. “Pet owners are using handheld devices like a phone or tablet for everything. We need to scale everything into those form sizes. Technology needs to scale itself, and we need to build the technology to facilitate that layout.”

With Wagly promoting itself as offering pet owners a convenient approach to complete pet care, its aim is to provide a vast array of services, from grooming to vet care, integrated under one roof. According to Susen, the world is a moving business where intelligence drives that business, thus market focus and human engagement are extremely valuable. He compared the concept to a visit to Starbucks, where employees know customers by name.

“When they say ‘Hello, Craig,’ I’m going back to that Starbucks because they know me,” he explained. “That’s not digital anything. It’s they know me. When you’re talking about health, it’s more complicated. At Wagly, we want to know about your pet. We continue to engage on total health of your pet. It creates a bond between the pet owner and ourselves. Knowing the pet name is huge, as is knowing what is going on with that pet.”

Convenience is important, as is the collection of data and instrumentation of that data. Digital marketing, keeping track of services and understanding search engine optimization are all aspects that have grown relevant. If Wagly is going to optimize its business intelligence and interaction with customers, Susen believes that wearables and the cloud are going to be a part of the modern user experience. He considers wearables to be more than a fitness product.

“High tech GPS collars give us great information,” he said. “They allow you to manage the safety of a dog and understand its tendencies. They help you understand things like how a dog interacts with fence line issues. They can send an owner a text message when the dog is outside the perimeter of the yard or outside in the Wagly parking lot. If the dog is coughing, we can take it in the back entrance to avoid the possibility of contaminating other dogs. When we’re boarding a pet, we can use that technology to show a pet owner where the dog is at any given time.

“And heavy duty, Windows-based technology is antiquated. It’s all clicks. Our employees are millennials. They want it streamlined. The cloud is a ready feature; the challenge is the devices. This information needs to move to the cloud. It will dramatically change the world. It will allow veterinary practices to update in real time. We’re moving from click heavy to streamlined.”

Today, Tomorrow

The current state of the pet industry is far different from what it was in 1971. Doug Pointexter, president of World Pet Association (WPA), has witnessed the changes as a consumer and a retailer when he was the owner of Doug’s Animal House. Thanks to SuperZoo, a leading pet retail trade exposition and conference produced by WPA, he continues to witness the growth of the industry.

“When I first entered the industry as a tropical fish hobbyist more than 40 years ago, it was very much family run, especially on the retail side,” he recalled. “Today, it’s a more than $65 billion industry with pet products in almost every retail setting you could think of.”

This is good news for the likes of Cathy McMullen, owner of One of the Family Pet Supply in Middlesex, New Jersey. Since opening her independent shop 6 years ago, she’s noticed the evolution of the industry, specifically in terms of the variety, quality and nutrition in pet foods.

She has also seen the changes in pet owners who buy those foods, noting that consumers are taking more of an interest in the nutritional value of the food they’re giving their pets as well as natural medicine like probiotics.

“Customers are often seeking specialized and homeopathic products,” she said. “I’m noticing more people asking for health care products too, like CBGs (Cannabigerol) and supplements for pets with things like anxiety, cancer and eating disorders.”

However, one aspect that hasn’t changed—and that’s not likely going to change—she pointed out, is the value of customer service.

“We spend a lot of time with our customers,” she said. “We offer personal service and people appreciate it. We take the time to talk to customers. We don’t tell them what to do. We give them choices, and let them do their own research. We let them own it.”

On the topic of ownership, since Pet Age was launched in 1971, it has continued to be published by only two other owners.

In the fall of 2012, the Backer family sold it to Harrisburg, Pennsylvania-based Journal Multimedia. CEO David Schankweiler and President Larry Kluger owned and operated the media brand until May 2016, when they sold all of Journal Multimedia to what is now known as BridgeTower Media, a division of Gatehouse Media of Pittsford, New York.

Executive Publisher Allen Basis offers a bright outlook for Pet Age and the pet industry as a whole.

“Pet Age is more of a media brand than just a magazine,” he said. “Together with our website, newsletters, events and awards, Pet Age is poised to cover the industry and, as Horst H. Backer wrote in our inaugural issue, ‘to expand your profits in particular and to extend the influence of the pet industry in general.’

“The pet industry itself has come so far the past four and a half decades. Just imagine what’s in store for decades to come.”